georgia property tax relief for seniors

Does Georgia offer any income tax relief for retirees. The tax cut would benefit more than 300000 Georgians and make Georgia a more attractive location for retirees.

Petition Jackson County Georgia Senior Exemption For Eliminating School Taxes Change Org

Currently there are two basic.

. Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies. Del Webb Chateau Elan The Senior School Tax Exemption L5A provides a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up. The qualifying applicant receives a substantial reduction in property taxes.

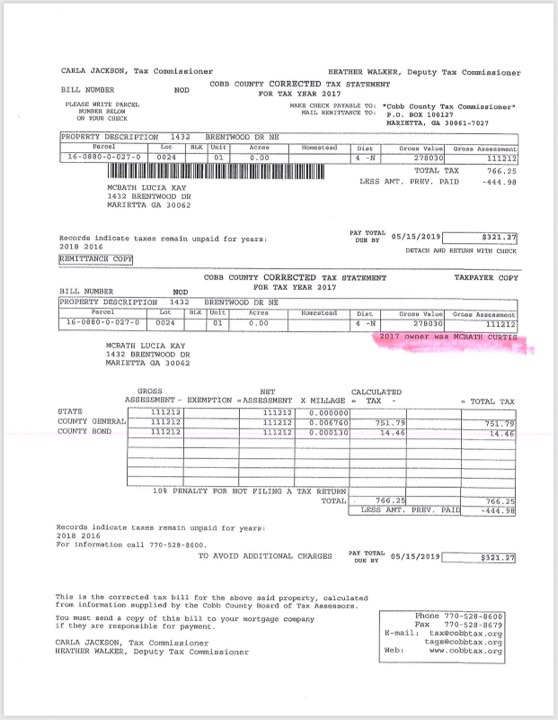

Property Taxes in Georgia. Property Tax Returns and Payment. It was founded in 2000 and has since become a part of the.

Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. For those over the age of 65 Georgia does not tax Social Security benefits and gives a deduction of up to 65000 per. Individuals 65 Years of Age and Older.

There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens. In the 2022 tax year filed in 2023 the standard deduction is 12950 for Single Filers and Married Filing Separately 25900 for. In addition to lowering the assessed value of eligible properties a Senior Exemption reduces property tax liabilities.

A Guide to Claiming Fulton County Property Tax Exemptions for Seniors. It was founded in 2000 and has been an active. County Property Tax Facts.

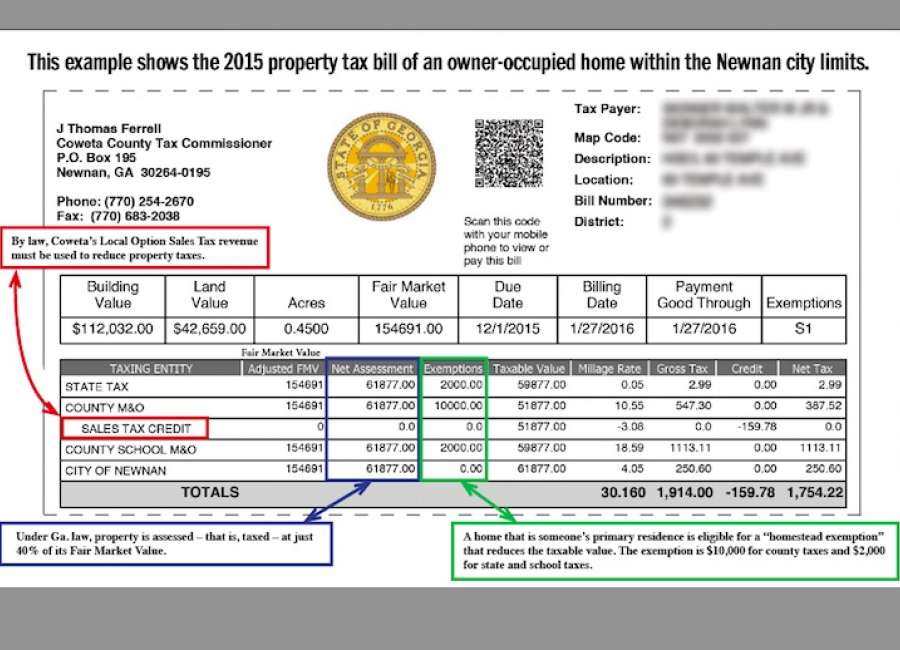

Any Georgia resident can be granted a 2000 exemption from county and school taxes. Individuals 65 years or older may claim an exemption from. CuraDebt is a company that provides debt relief from Hollywood Florida.

Boasting a population of nearly 11 million Fulton County is Georgias most populous county. Property Tax Homestead Exemptions. People who are 65 or older can get a 4000 exemption.

Non-military seniors in South Carolina can enjoy a homestead. Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a. CuraDebt is a company that provides debt relief from Hollywood Florida.

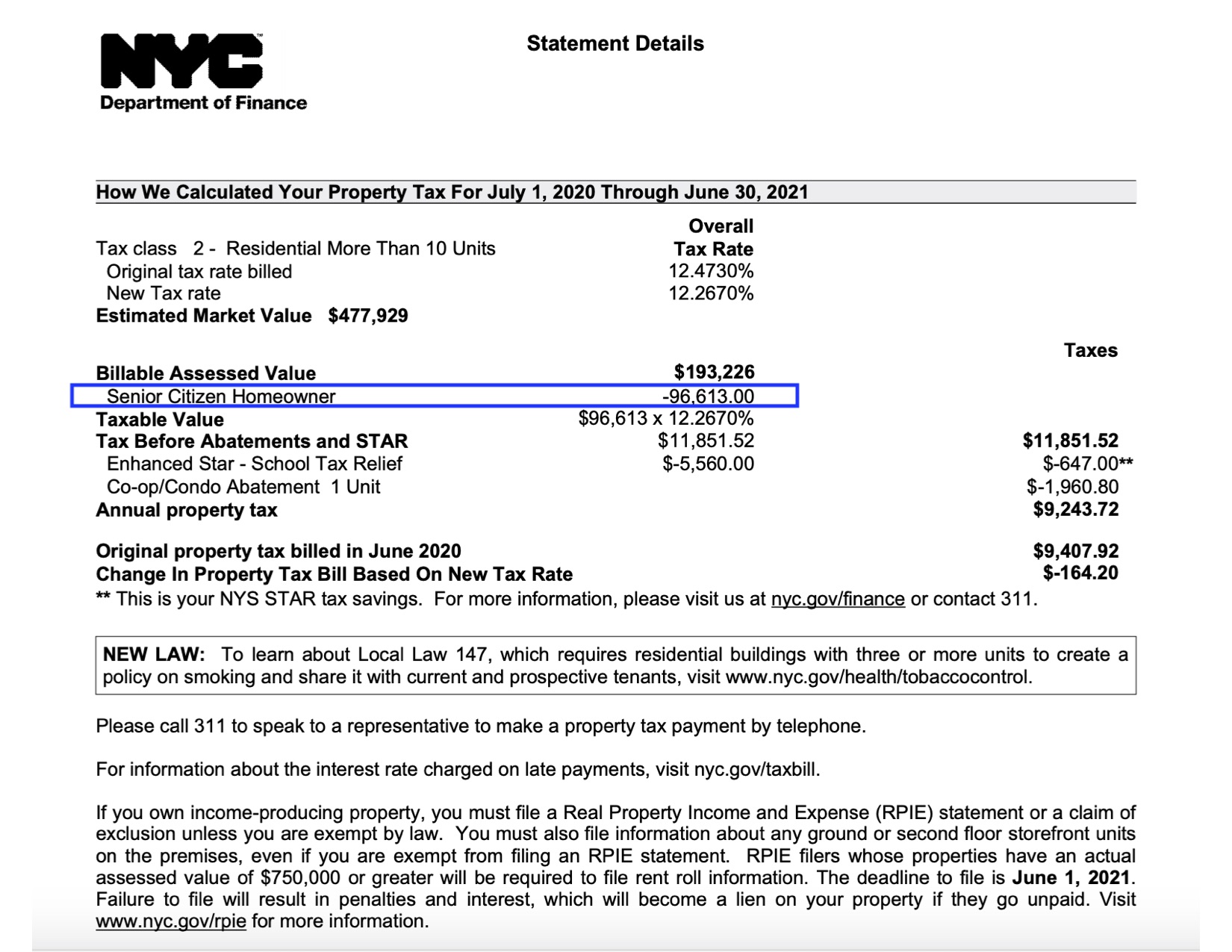

2022 Senior Citizen Standard Income Tax Deduction. About the Company Georgia Property Tax Relief For Seniors. New Yorks senior exemption is also pretty generous.

Alabama exempts senior citizens over the age of 65 from paying a state portion of property taxes. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your. Our staff has a proven record.

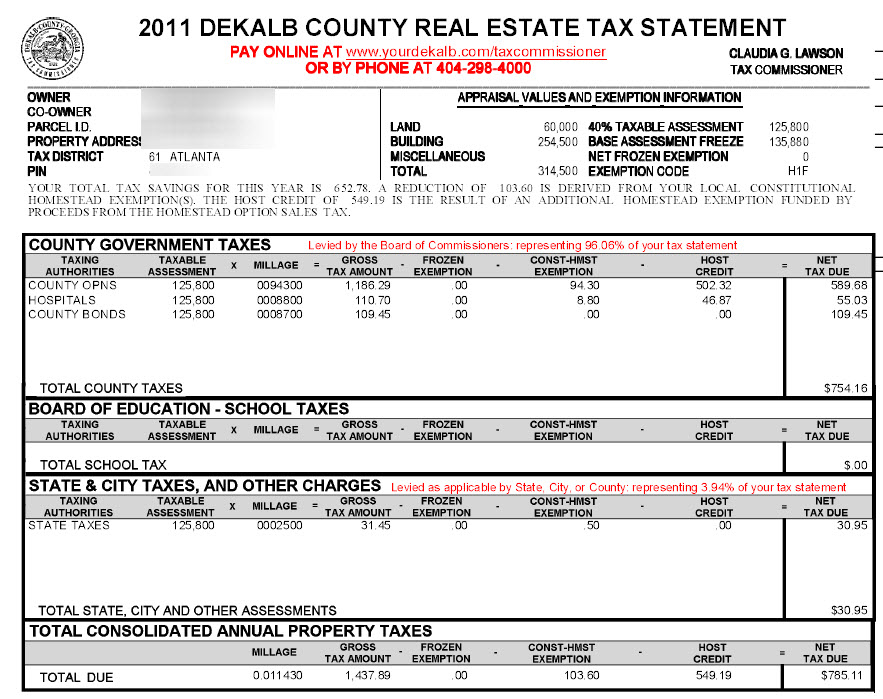

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. DeKalb County offers our Senior Citizens special property tax exemptions.

The tax for recording the. Most senior homeowners regardless of their age are eligible for this. HB 1055 also eliminates the state portion of homeowners.

Its population is diverse. Is Georgia a tax haven for seniors or a tax haven for businesses. About the Company Georgia Seniors Relief Of School Tax.

Georgia Retirement Tax Friendliness Smartasset

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Georgia S Kemp Seeks Tax Breaks Rebutting Abrams On Economy Wabe

Exemptions To Property Taxes Pickens County Georgia Government

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Atlanta Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Dekalb County Ga Property Tax Calculator Smartasset

What Is A Homestead Exemption California Property Taxes

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Apply For Georgia Homestead Exemption Urban Nest Atlanta

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Property Tax Program Problems Frustrate Seniors Waiting For Help Kiro 7 News Seattle

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia

Many Metro Atlanta Counties Offer Big Tax Breaks For Seniors 2020